How to start business in France

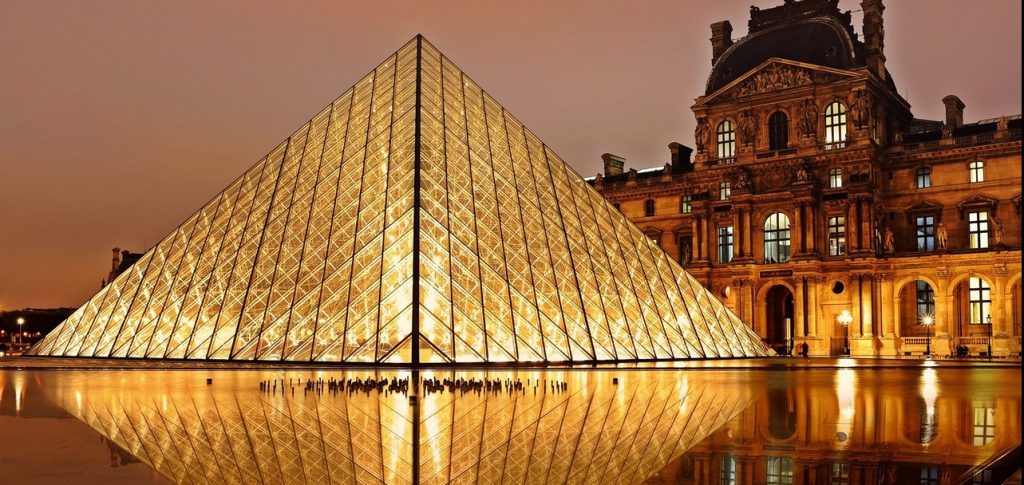

France – the country of Moliere, camembert cheese and Eiffel Tower. This is not only a good destination for touristic and educational reasons. France is an often-chosen place for opening a business there. The particular part of this country attracts global entrepreneurs according to the kind of business they want to run. For example, Paris has got one of the biggest hubs in the world, so that might sounds invitingly for transport companies. On the other hand, Marsylia is the leading domestic metallurgical industry center. So starting a business in this city can be attractive for the entity who handles in iron smelting. Why entrepreneurs choose France and why you should join them? Besides working in the beautiful country, where you can drink wine for dinner, the economy of this country is based on dominating the private sector and France is a member of G8 – a group of the most industrialized countries all over the world. But no matter of reason why and where you decide to choose to open a business in France, you need to get to know some information about formation process and this is what we would like to present in the article below. 1. Business in France – step by step guide

In order to better understanding the formation process, we highlight some basic points on how to start a business in France. From a business plan creation to regulations and standard you are obliged to comply with.

1.1 A good idea is the ground

There would be no thriving business without a previous idea for it. Writing a business plan lets you clarify your goals, market segment, a strategy and all operations connected with management. Before you create it, carry out research, weigh up the pros and cons and analyze your competitors’ actions on the market. When you do it in an organized way, you would look reliable in the eyes of the business bank account manager.

During the business, plan creation does not forget about taking into account elements such as financial issues and general marketing plans. Try to write easy-to-read sentences and do not make it too complicated with tumid descriptions. If there is a possibility, you can place some photos and graphics – it is eye-catching and adds extra value.

1.2 Be subjected to the French law

Starting a business in France is related to meeting some formal conditions and law regulations. Before you begin scanning all legal acts in France, decide what structure your company would have. You can choose from the following options:

- limited company

- business corporation

- simplified stock corporation

Naturally, you also can make a business as a sole trader. This type is often chosen kind of structure because of the possibility to change it later and become of a limited company. The form is dependable on the fiscal status and other formal conditions you need to meet.

Let’s look at the example of general requirements of the formation of the limited liability corporation. If you want to open a business in France in this way, you should know that your company name cannot be the same as an already registered business. Remember that you are also obliged to have a registered office and determine financial year-end.

Surely, there is a question-begging because you need to know how much time the process will last. We can estimate it for about 3-4 weeks, and the particular date depends on the day all information and documentation about your business would be received to the proper institution. Do not forget about formation costs which fluctuate between 2 500 and 4 800 EUR.

No matter what type of structure you decide to deal under, in case of some formal problems or misunderstandings you can always use services of special formation agent or a lawyer, which might be useful in picking the most profitable option for you.

1.3 Bank account is essential

Opening a business in France is connected to opening an individual business bank account. You need to be prepared for an interview with a banker, who would pump you for information about your business idea. So (as we have stated before) creation a detailed business plan might be something really useful for you. The bank requires some documents in order to open the business bank account. You should take the proof of address, a valid passport, and a Trade Register certificate. In this part of the guide, it is worth to mention that banks charge some fees for bank account maintenance. From a yearly perspective, it is about 30 EUR. Additionally, there are other costs for an international credit card (about 40 EUR) or the international banking transfers (about 20 EUR + commission). Speaking of money…be prepared to deposit a minimum share capital. The amount is dependable on the type of business structure you would choose. For instance, a minimum share capital for SA (Societe Anonyme) is 37.000 EUR and for SAS (Simplified Stock Company) is a symbolic 1 EUR. This process is approved by a special certificate which is an essential element in following steps toward opening a business in France.

1.4 Registration process

Having necessary documentation which confirms the legality of the company lets you register the business with Trade and Company Registry (Registre du Commerce et des Sociétés), then sending a completed form to specific registration center (Centre de Formalités des Entreprises). The information must provide elements such as:

- a certification stating the minimum share capital deposited in the bank,

- a declaration M0 which includes details about the company (name, capital, shareholders, representatives),

- confirmation of being published in a legal newspaper,

- copies of diplomas (if it is required by law for following a profession, e.g. architects or attorneys).

After receiving all crucial documents, Centre de Formalités des Entreprises sends information to other offices in the country for the rest of the registration issues.

A registration process is correlated with a special document called Extrait Kbis. This is a kind of legal proof of existence the businesses which are registered with the Registre du Commerce et des Sociétés and it includes NEF code (code from activities classification), the name, address, date of incorporation and so on. The legal document opens doors for your bank account activation and receives a VAT number. Staying in the VAT affair, taxes paying depends on the type of business you decide to go under and on the income, your company will gain. In light of the law, companies must pay corporate tax, social contribution and special tax if the turnover of the business is estimated for more than 250 million EUR.

A registration process is correlated with a special document called Extrait Kbis. This is a kind of legal proof of existence the businesses which are registered with the Registre du Commerce et des Sociétés and it includes NEF code (code from activities classification), the name, address, date of incorporation and so on. The legal document opens doors for your bank account activation and receives a VAT number. Staying in the VAT affair, taxes paying depends on the type of business you decide to go under and on the income, your company will gain. In light of the law, companies must pay corporate tax, social contribution and special tax if the turnover of the business is estimated for more than 250 million EUR.

1.5 A possibility to open a branch office

Starting a business in France is also possible through opening a branch office of your already-established company. In this case, you must register the branch office at the Register of Commerce and Companies. There are requirements to provide two copies of articles of association and certificate of incorporation, the completed application form from French Companies Registrar or approvals for operations which would be undertaken by this branch. Pay attention to translating all documents into French. If the information is correct, you will wait no longer than 15 days for submitting in this specific France business registry. Thinking about the principles of laws in the situation where the branch of your domestic company is placed in France, you should know that the director of it is amenable to the law of the country where the company is originally registered in. On the other hand, employees who work in the branch office are under the French Labor Law. 2. Summary

The perspective of a fast developing economy in France and its tolerant attitude to foreigners attracts entrepreneurs from other countries to take advantage and open a business in France. A process of setting up a company isn’t so complicated. You have some options for your business structures to choose – everything depends on your business idea and purse. There is not strictly defined time of registration process and it is intertwined with all necessary documents complements. You can always use the services of special French accountants who are known as “experts compatible”. With their piece of advice, you will not be worried about taxes matters or amendments to provisions in force. So now, there is nothing more to do than creating a business plan and go into effect. We hope you join the successful businessmen not only in France, but your company name would be known all over the world!